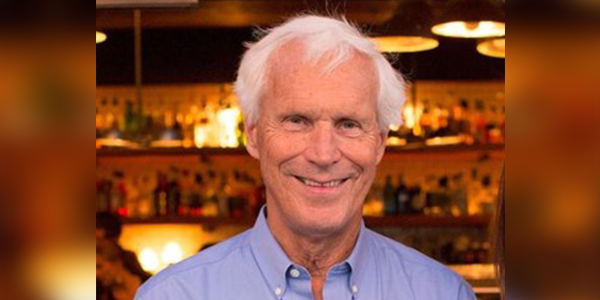

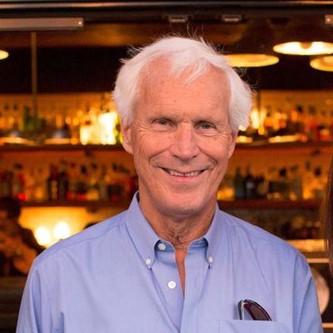

The Livable World Legacy Society Charles D. (Kim) Kimbell: A Tireless Advocate for the Environment

Kim Kimbell, our legacy donor featured this month, loves nature, is an avid surfer and swimmer, and is a champion of conservation. After growing up in Indiana where he went to law school, he discovered California as the land of endless summer, ultimately moving to Santa Barbara in 1972. He and his late wife, Terry, and their children eventually settled in Hope Ranch, where he was, and remains, enthralled by the glorious beach.

Kim demonstrated his commitment to environmental stewardship with extensive improvements to his own ranch-style home built in the 1950s, which he and Terry purchased in 1980. Upon moving in they immediately began reducing energy waste and inefficiency by adding insulation and replacing leaky windows with dual-pane glass. He added a solar water heating system and installed a photovoltaic system when that was still a relative novelty.

Kim joined the law office of George Allen in 1972 and helped establish a practice that used his legal training and experience as a powerful tool for translating his passion for the environment into practice. He worked with developers to help them incorporate strong environmental protections into their projects and assisted homeowner associations in crafting governance frameworks that were both environmentally and socially sensitive. Among other accomplishments, Kim helped to substantially update and revise the Hope Ranch Covenants, Conditions, and Restrictions, and he served as counsel for the developer of Hollister Ranch, ensuring that the development would be ecologically responsible and preserve the natural gifts of this relatively unspoiled landscape.

His work with the Community Environmental Council (CEC) began in 1992, terming off the board in 2020. As a former dynamic board member who demonstrated an unflagging engagement with and support of the organization, Kim earned a spot on the organization's President's Council. The President's Council is a group of past executive directors, Board members, and founders - as well as esteemed CEC friends - who have given significantly of their time, effort, and resources to the organization. Kim is one of a small handful of notable community leaders who serve in this way, committing to being an active, consistent champion for CEC in the broader community.

It is a source of satisfaction for Kim that he has been able to pass on his love of surfing and nature to his three sons and six grandchildren who love to visit his place in Hope Ranch. He has designated a generous legacy gift to the Community Environmental Council in his Living Trust, not only as an expression of his commitment to CEC and its mission but also as part of his desire that future generations should inherit a livable and healthy world.